IBM has enjoyed growth across all business segments this third quarter resulting in total revenue of $14.1b, up six percent and 15 percent at constant currency. Infrastructure and hybrid cloud results were both up 15 percent, with constant currency up 23 percent and 20 percent, respectively. Consulting and software revenue also experienced growth.

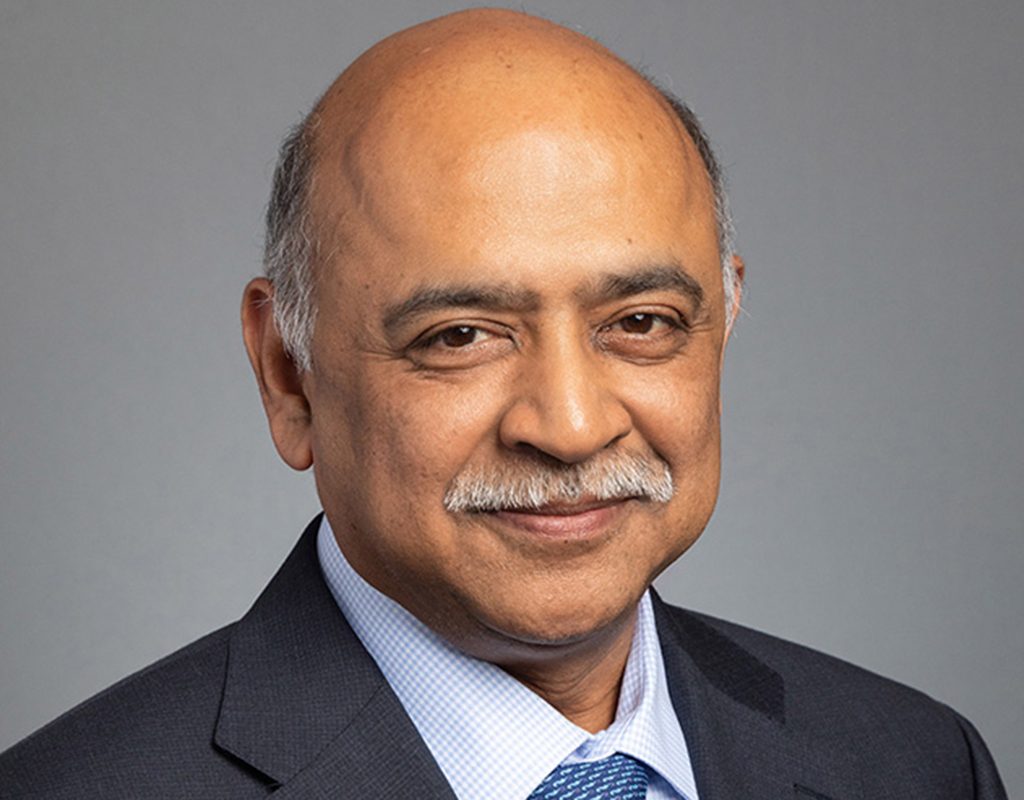

IBM chairman and chief executive officer, Arvind Krishna, said: “IBM delivered strong revenue growth in the quarter, reflecting our continued focus on the execution of our strategy. Globally, clients view technology as an opportunity to enhance their business, which is evident in the results across our portfolio.”

Total cash on hand was recorded at $9.7bn, up $2.2bn from the year-end 2021. At the end of the quarter, the company returned $1.5bn to shareholders via dividends.

“Both our revenue growth and operating profit profile for the first three quarters of the year align to the investment thesis we outlined last fall,” said James Kavanaugh, IBM senior vice president and chief financial officer. “Our portfolio mix, business fundamentals, strong recurring revenue stream and solid cash generation allow us to invest for continued growth and return value to shareholders through dividends.”

Sales to the former IBM unit, Kyndryl, have resulted in significant percentage gains across multiple segments, most notably software and infrastructure, with total revenue up five points. The IBM-Kyndryl separation was completed at the end of 2021.

Their highest performing sector was software, with reported revenue of $5.8bn, with Red Hat and Transaction Processing bringing home the bulk of the percentage gains.

The third quarter results bode well for the overall revenue growth for the year. IBM is now expecting constant currency growth above the mid-single digits. In addition, the current expectation for consolidated free cash flow is $10bn. With the October currency exchange rates, there is expected to be a seven-point headwind on revenue growth.