ERP Today has established itself as THE independent voice of the enterprise technology sector through its use of dynamic journalism, creativity and purpose.

SubscribeFinancial Management

Orbit Analytics Launches Blaze Adaptive Memory for GL Sense

Orbit Analytics has launched an intelligent upgrade to its GL Sense reporting solution for Oracle ERP users, featuring the new Blaze Adaptive Memory technology that enhances real-time data accessibility and reporting efficiency by adapting to user behavior.

Why Billing Doesn’t Belong in ERP: Insights from ISG & 24 Hour Fitness on Accelerating Digital Transformation

This webinar explores why modern businesses like 24 Hour Fitness are unbundling billing from ERPs to accelerate transformation, featuring expert insights from ISG and Zuora.

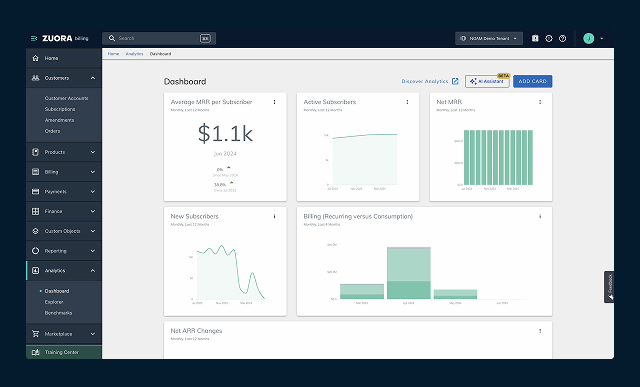

Adapt fast & monetize any business model

Take an interactive tour of Zuora Billing and see how it streamlines quote-to-cash, handles complex pricing models, and empowers teams to quickly adapt to market changes.

How ERP System Integration Can Improve Your Financial Close

ERP system integration streamlines the financial close process by automating data collection, reducing errors, and providing real-time insights, ultimately enhancing efficiency, compliance, and decision-making for enterprises.

SAP Users: Automating SAP Financial Closing with Aico

The article discusses the complexities and manual nature of financial closing in SAP, highlighting the benefits of automation—such as increased efficiency, enhanced accuracy, regulatory compliance, cost savings, and improved visibility—while emphasizing the necessity for organizations, particularly CFOs and finance leaders, to adopt automated solutions like Aico to streamline the closing process and reduce reliance on manual tasks.

Aico’s guide to non-trade intercompany invoicing

This guide highlights the challenges of non-trade intercompany invoicing, including inefficiencies of traditional ERP systems and common errors, while outlining strategies for implementing streamlined, automated processes to enhance accuracy and mitigate reporting risks.

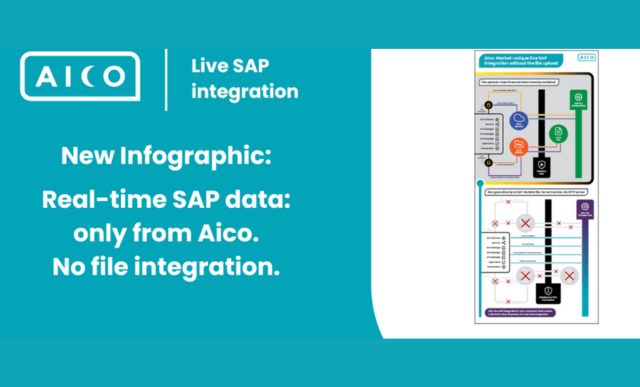

Genuine live SAP integration without the file upload

Aico’s live SAP integration provides real-time access to financial close data, eliminating batch uploads and file transfers to enhance accuracy and streamline decision-making for finance teams.

Intercompany Invoicing

Aico eliminates manual intercompany invoice matching as the reference field in the correct sister company’s ledger is identical.

Closing Task Manager

Access a centralised dashboard that provides real-time updates on every stage of the financial close process. Tasks are seamlessly linked, so one team member can pick up where another left off, ensuring continuity and efficiency.

Accelerating Digital Transformation and Billing Modernization

By focusing fully on all potential sources of value, a truer picture emerges, one that focuses on the impact on the business rather than a narrower cost savings discussion. An independent revenue platform also contains a valuable source of data on customer behavior and product and service performance.

Case Study: 24 Hour Fitness

Learn how 24 Hour Fitness overcame ERP limitations by implementing Zuora to support new pricing strategies, improve billing agility, and better serve over 1 million members.

Zuora Connector for SAP Solutions

Discover how Zuora complements SAP by adding agility to order-to-cash processes, freeing businesses from rigid ERP billing systems and enabling faster, recurring revenue growth.

Rootstock Financials

With Rootstock Financials, product companies gain full finance visibility, robust planning and analysis, and more accurate forecasting so teams can make better, faster decisions with confidence.

Breaking the 3-5 Year ERP Migration Trap: Why 24 Hour Fitness Didn’t Wait for Cloud Transformation

24 Hour Fitness successfully transformed its billing process from a six-day cycle to daily billing by implementing Zuora's monetization platform alongside its existing ERP systems, demonstrating that simultaneous modernization can enhance cash flow, innovate product offerings, and maintain integration flexibility during enterprise technology migrations.

The Great Finance Time Drain: Professional Services Firms Are Burning 44 Hours a Week on Financial Fire-Fighting

Unit4's research reveals that finance teams in professional services are inefficiently spending significant time resolving financial discrepancies and consolidating year-end reports due to a lack of automated processes and unified data sources, leading to burnout and strategic disadvantages for organizations.

Finding the Right Solution for Global Tax Compliance

The global marketplace is growing more complex and volatile. Companies must use every resource at their disposal to keep pace, protect profit margins, and remain compliant with all applicable regulations. As companies grow and expand operations, these challenges only get...

Overcoming Tariff Uncertainty with Oracle NetSuite

Tariff uncertainty poses significant challenges for global companies by increasing costs and disrupting supply chains, but leveraging tools and data-driven strategies, such as those offered by Oracle NetSuite, can help mitigate these impacts through cost tracking, supplier diversification, and scenario planning.

Key metrics to monitor in order management

Effective order management, underpinned by key metrics such as order accuracy rate, order cycle time, inventory turnover rate, on-time delivery rate, and order fulfillment cost per order, is essential for optimizing operations, enhancing customer satisfaction, and driving long-term business success.

Revenue recognition is complex. We make it simple.

With pre-built connectors to leading ERPs, compatibility to Amazon Web Services & Microsoft Azure, and a one-click onboarding experience, Zuora Revenue easily fits into any ecosystem. You can expect to get started quick and see value fast.

Scale your revenue growth with AI payment optimization

As your customers change how they want to access your products and services, you have to evolve how you do business. Learn more about how our leading Subscription Economy® solutions have helped many of the world’s most innovative subscription businesses succeed.

Zuora Billing

Zuora Billing is the leading solution for automating subscription, usage-based, and hybrid billing, offering flexibility and control to monetize any business model.

Expense management automation: Strategic insights for finance leaders

Explore advanced strategies for implementing expense management automation and how it can enhance compliance, efficiency, and financial insight.

Navigating Tariffs with NetSuite

Tariff uncertainty is weighing on companies, reducing their ability to make strategic business and supply chain decisions. The best defense against volatility is having the right tools, data, and insights to help make quick, data-driven decisions.

East of England Ambulance

Significantly reduced budgeting and forecasting times plus more timely and accurate data with Unit4 F,P&A.

GLSense: Integrated Financial Reporting for Excel Users

While Excel remains an essential tool for finance teams creating accurate financial statements, its widespread use introduces significant risks including human error and data loss due to inadequate governance and desktop-based limitations. Download our comprehensive report to enhance your team's skills and unlock advanced capabilities for more secure and efficient financial operations.

Meeting the Financial Needs of the Modern CFO with Trintech’s Michael Ross

CFOs are facing increasing challenges amid stagnant budgets and complex regulations, necessitating partnerships with specialized providers like Trintech to enhance ERP functionalities, leverage AI for automation, and adopt tailored solutions for diverse organizational needs, particularly in financial services and retail.

How CFOs can Navigate Challenges to Deliver Real-time Results

The evolving role of CFOs requires them to be strategically involved across organizations, leveraging real-time data and advanced tools to drive performance, optimize operations, and support agile decision-making amid changing economic landscapes.

Vertex: Connections That Win

Vertex, Inc., a leading global indirect tax technology company, experienced transformative growth in 2024 with a 16% revenue increase to $667 million and nearly doubled stock prices, driven by advanced capabilities and a commitment to long-term thinking, while emphasizing trust and collaboration with customers to navigate the evolving tax compliance landscape amid rapid changes in technology and regulation.