IBM has released its first quarter 2023 results with a current revenue of $14.3bn, up 0.4 percent, up 4.4 percent at constant currency, demonstrating steady growth for the company.

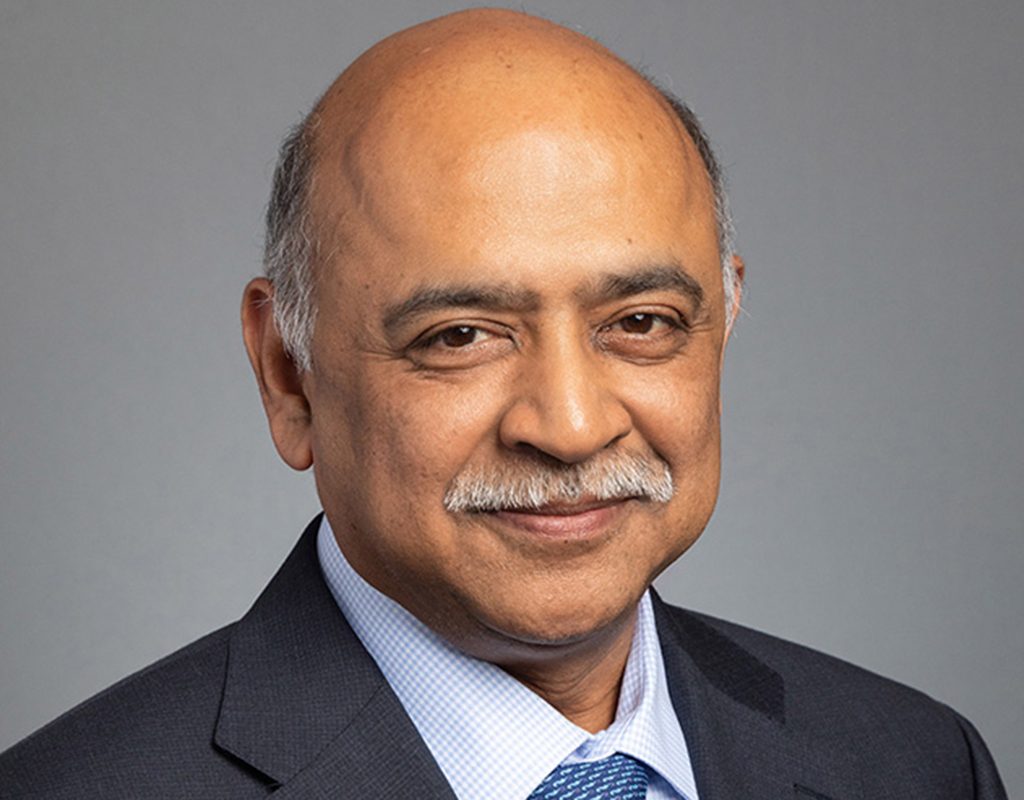

The firm’s performance was led by software and consulting, with these sectors bringing in roughly 75 percent of annual revenue. Software revenues were $5.9bn, rising 2.6 percent or 5.6 percent at constant currency and consulting revenues were $5.0bn, up 2.8 percent and 8.2 percent at constant currency. However, the firm has seen a deceleration in consulting results from the previous robust growth levels, especially in the United States, as IBM chairman and CEO, Arvind Krishna, remarked in the Q1 earnings call.

Elsewhere, infrastructure revenues were $3.1bn, down 3.7 percent, but up 0.1 percent at constant currency. IBM financing revenues were $0.2bn, up 27.3 percent, up 31.0 percent at constant currency.

Net cash from operating activities rose $0.5bn, reaching $3.8bn, while free cash flow was up $0.1bn to $1.3bn. Net cash from operating activities excluding IBM Financing receivables was $1.8bn. IBM’s free cash flow was $1.3bn, up $0.1bn year-on-year.

Operating income was impacted, meanwhile, as the firm also took $260m of the $300m total costs of its ‘workforce rebalancing’ this quarter, following the announcement of 3,900 positions job cuts, 1.5 percent of its global workforce, back in January.

IBM has ended the first quarter with $17.6bn of cash and marketable securities, an increase of $8.8bn from year-end 2022. Additionally, the company returned $1.5bn to shareholders in dividends in the first quarter.

The company’s first quarter success follows from its devotion to the tandem technologies of hybrid cloud and AI, which together have seen cloud engagements experience a 70 percent faster time to value. Q1 has seen many collaborations and partnerships incorporating these technologies, including the likes of Wasabi Technologies, Citi, EY, Adobe, Siemens and many more.

Notably, Virgin Money also joined the IBM fold, migrating its credit card service to the IBM cloud for financial services and leveraging IBM’s consulting capabilities. Juniper Networks and Nokia additionally expanded their partnerships with the firm.

“Our first quarter results demonstrate that clients continue turning to IBM for our unique combination of an open hybrid cloud platform, enterprise-focused AI and business expertise to unlock productivity and drive efficiency in their operations,” Krishna continued in the company earnings call. “This gives us confidence in our current growth expectations for revenue and free cash flow for the year.

“I think the movement towards hybrid cloud and the ability to take advantage of AI for enterprise productivity is perhaps going to be a tailwind as we enter the second half of the year because I do think that clients are going to do a lot of automation and a lot of cost cutting, which will likely benefit elements of our software portfolio,.” Krishna said.

James Kavanaugh, IBM senior vice president and chief financial officer, said: “In the quarter, we remained focused on the fundamentals of our business, increasing productivity and generating operating leverage.

“As a result, we again expanded our gross profit margin, improved our underlying profit performance and increased our cash generation. We are well-positioned to continue investing for growth and returning value to shareholders through dividends.”