Since the outbreak of COVID-19, payroll professionals have had just weeks to prepare for the Coronavirus Job Retention Scheme (CJRS) and the new calculations required to work out claims in respect of furloughed staff.

As payroll software provider to half of the UK’s private sector businesses, Sage aimed to make the payroll process as straightforward as possible for customers through automating much of what they need to do to make a valid claim.

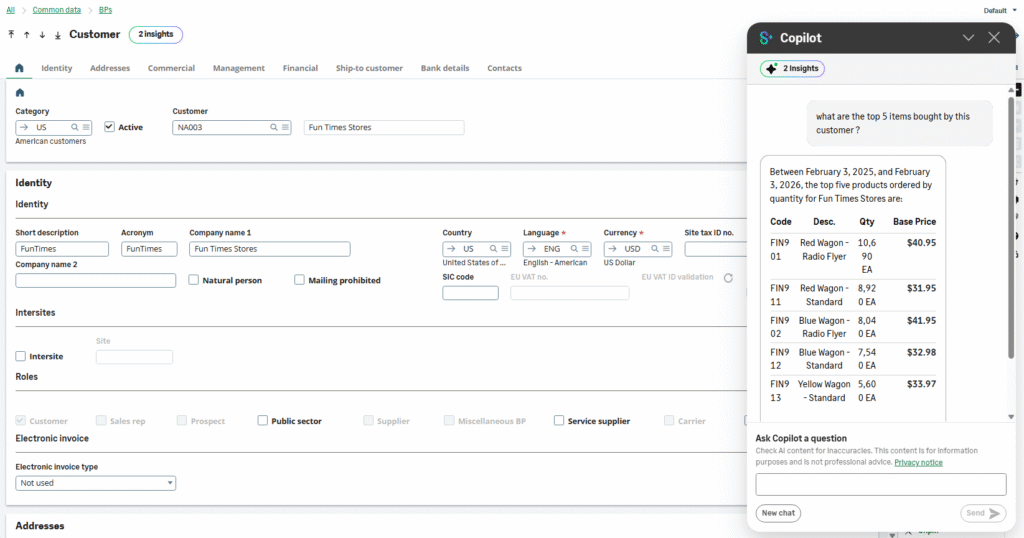

The company built a prototype automated in-product payroll functionality to process the complex calculations needed to apply for CJRS grants and used its existing payroll data to support the build of the complex new calculations. To account for the variation between different customers, Sage also developed a module that could ask the customer questions as they progressed through the process.

Working with HMRC, Sage was able to provide insight into how to deliver a realistic solution for businesses, determine what employers were expected to submit and the basis of the calculations.