Workday has announced financial results for its fiscal 2023 fourth quarter and full year ended 31 January 2023, with revenue wins inching the firm ever closer to its 2025 $10bn target.

For the full fiscal year, Workday’s total revenues jumped 21 percent when compared to fiscal 2022, reaching $6.22bn and showcasing consistent growth over the year.

Total quarterly revenues supported this increase, rising 19.6 percent to $1.65bn in Q4 year-on-year. Alongside this, Q4 subscription revenues increased 21.7 percent to $1.5bn, matching the announcement from co-CEO Aneel Bhusri that the company has reached 10,000 customers globally in Q4.

Subscription revenue backlog also continued to overshoot the 20 percent growth target. The two-year backlog increased by 21.3 percent to $9.68bn, bringing the total subscription revenue backlog to $16.45bn, a 28.4 percent increase YoY.

Meanwhile, despite Q4 operating losses shrinking almost two points YoY to $89.0m, operating losses for the full fiscal year 2023 grew by another point from fiscal 2022. Increasing 3.6 percent YoY, yearly operating losses reached a total of $222.2m.

Operating cash flows grew, however, to $1.66bn compared to $1.65bn in the prior year and cash, cash equivalents and marketable securities almost doubled YoY from $3.64bn to $6.12bn as of January 31, 2023.

Looking ahead, Workday is doubling down on AI and ML investment through Workday Ventures, having announced a $250m expansion of the fund to focus on larger growth areas such as generative AI. The firm will also continue to branch into SME, niche industry and EMEA markets in line with ongoing business expansion plans.

For the financial year 2024 ahead, the firm is temporarily dropping its subscription revenue guidance to up to 18 percent YoY growth due to current macro environment uncertainty, predicting up to $6.575bn in value. First quarter 2024 cash flow is also predicted to be impacted by the launch of the firm’s performance-based cash bonus plan and recent severance costs.

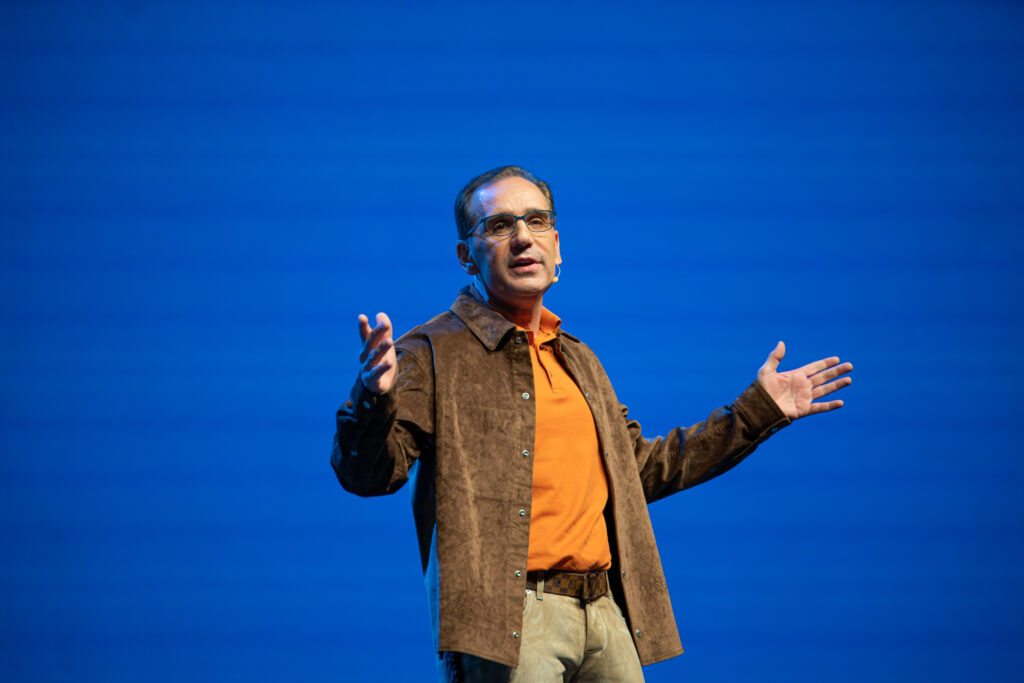

“We closed our fiscal year with another solid quarter, further reinforcing the strength of our value proposition as more organizations continue to select Workday to help manage their people and finances,” said Aneel Bhusri, co-founder, co-CEO and chair, Workday. “Despite the unpredictable environment, we remain well-positioned to drive the future of work for our more than 10,000 customers thanks to our amazing employees and unique approach to embedding artificial intelligence and machine learning into the very core of our platform.”

“We have a clear strategy in place heading into fiscal 2024, and our land opportunity with net new finance and HR customers is wide open as we continue to gain ground with both large and medium-sized enterprises across the globe,” said Carl Eschenbach, co-CEO, Workday. “We are doubling down in strategic growth areas by investing in our customer base, focusing on key industries, evolving and investing in our partner ecosystem, and relentlessly focusing on innovation.”

More news from Workday is set to be revealed in the next issue of ERP Today, out next month.