Black & Veatch engineers have been leading the way in delivering engineering, procurement, consulting, and construction for over a century. Their trusted and sustainable water, power, and industrial expertise help clients solve their toughest infrastructure challenges. As the company expanded globally, managing thousands of projects across hundreds of global jurisdictions, the complexity of procurement and tax compliance grew exponentially.

The Challenge: Global Complexity Strains Legacy Systems

Black & Veatch continued to see global tax mandates intensify and digital compliance become a board-level priority. The company’s existing tax solution was creating bottlenecks in performance, scalability, and integration. It was time to modernize its legacy tax infrastructure. The goals: support global growth, reduce downtime, and meet evolving regulatory demands. As the business moved into new markets, IT faced mounting pressure to:

- Ensure high availability and uptime,

- Support real-time integration,

- Scale tax operations to meet multi-jurisdictional compliance requirements, and

- Empower tax with analytic capabilities to be even more strategic.

To meet these challenges, Black & Veatch launched a digital transformation initiative focused on finance, HR, and procurement. Central to this effort was the migration from a heavily customized version of Oracle E-Business Suite to Oracle Cloud ERP, which was deployed in Oracle Cloud Infrastructure (OCI).

Black & Veatch chose OCI for its scalable, secure, and high-performance cloud platform and ability to manage enterprise workloads. As part of the Oracle ERP migration, the company transitioned the on-premises tax engine to the cloud, leveraging the Vertex Accelerator for Oracle Cloud ERP.

The Solution: Vertex Accelerator, Vertex O Series

ROI timing was critical for Black & Veatch; it wanted to accelerate the time-to-value for the project. The Vertex Accelerator for Oracle Cloud ERP allowed the team to set up the Vertex tax engine faster and quickly get started. The Vertex prebuilt integration supports advanced tax management with a robust UI that simplifies onboarding, automates data mapping, and enables real-time testing.

The Accelerator ensures:

- Accurate tax determination using location and product taxability logic,

- Automated configuration and rule setup, and

- Real-time transaction monitoring and reporting.

When Black & Veatch migrated to Oracle Cloud ERP running on OCI, the company also migrated to Vertex’s solutions for Oracle Cloud, integrated through the Accelerator for Oracle Cloud ERP. This transition not only enhanced tax automation and performance but also aligned seamlessly with the company’s broader cloud-first IT strategy.

“The ease of adopting and moving to the cloud is what was most impressive to me, and the fact that within three months I’m already seeing improvements in reporting and other tax processes,” says Clifford Yeager, application portfolio manager at Black & Veatch. “We like the reports. We like the tax solution. We can now mature on this application.”

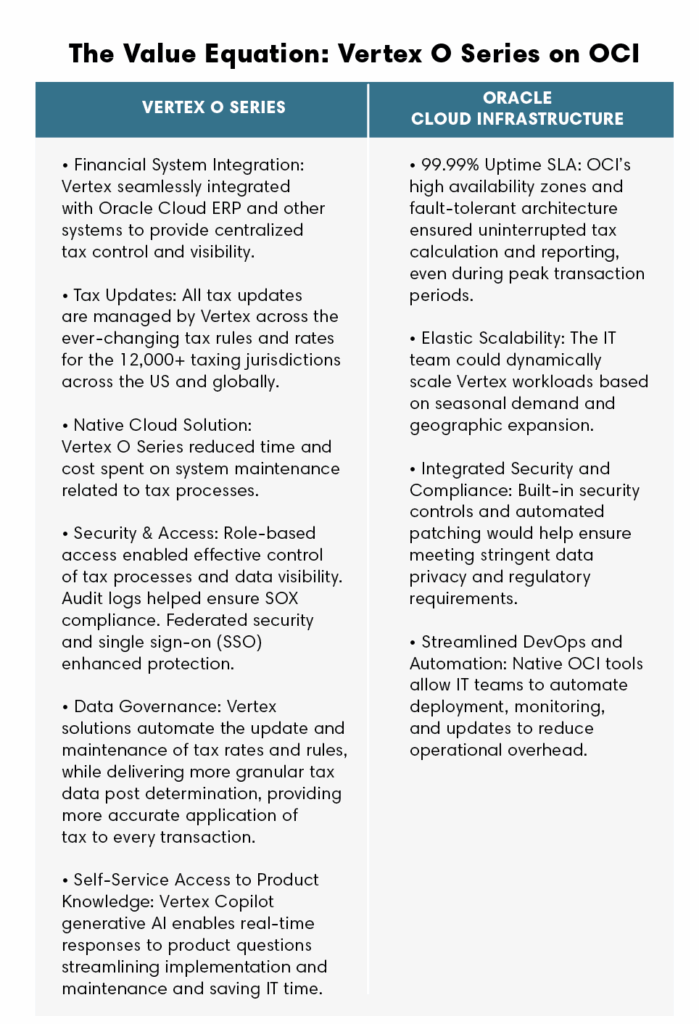

Built on a trusted foundation, Vertex solutions on OCI’s enterprise-grade architecture provided the performance, scalability, and security needed to support global tax operations. Vertex O Series provided the robust global tax controls needed to meet Black & Veatch’s growing international project base. See The Value Equation: Vertex O Series on OCI (Diagram 1). Working with Capgemini and Vertex, Black & Veatch was also able to customize workflows to ensure seamless data flow across intercompany transactions.

Migrating to Vertex solutions on OCI enabled the IT team to deliver a modern tax platform that is ready for the future of tax. It is also closely aligned with Black & Veatch’s 110-year history and commitment to delivering innovation and human infrastructure projects that shape the fabric of organizations. This transformation resulted in:

- Automated global tax updates and compliance reporting,

- Increased accuracy in tax determination, including complex intercompany transactions

- A complete, highly customized Oracle Cloud ERP migration and Vertex O Series migration on time.

The Power of Partnership

The strategic partnership between Oracle and Vertex gave IT leaders at Black & Veatch confidence in the long-term viability of the solution. Vertex, an Oracle Partner Network (OPN) member for over 30 years, offers validated integrations with Oracle Cloud ERP and Oracle E-Business Suite. Oracle itself uses Vertex for global tax, which supports the reliability and scalability of the integration.

With this strong relationship in place, Black and Veatch’s IT team knew innovation roadmaps would consistently be aligned. The deep integration between Oracle ERP systems and Vertex tax solutions gave them the ability to automate indirect tax determination and tax processes across the enterprise.

This long-term commitment to the partnership made it clear they could count on:

- More prebuilt connectors for Oracle ERP and other platforms as they evolve,

- Continuous performance tuning and cloud-native optimization, and

- Shared roadmap visibility.

Why the Black & Veatch Story is Important

By standardizing on Vertex O Series integrated with Oracle Cloud ERP on OCI, Black & Veatch has replaced fragmented legacy tax infrastructure with a unified, automated platform that scales for global growth. The combination of prebuilt integration, enterprise-grade cloud reliability, and always-current tax content has reduced operational risk while improving accuracy and visibility across thousands of projects and jurisdictions.

Tax is a strategic cloud workload. Treating global tax as a first-class workload on OCI shows how specialized engines like Vertex O Series can sit alongside core ERP to support complex, multi-jurisdiction operations without sacrificing performance or control. For ERP and product leaders, this shows the value of tightly integrated, cloud-native tax services that can scale with global program demands rather than relying on custom, brittle extensions.

Prebuilt accelerators change ERP transformation dynamics. The Vertex Accelerator for Oracle Cloud ERP demonstrates how prebuilt integrations, configuration automation, and real-time testing can compress time-to-value in large ERP migrations. For systems integrators and enterprise architects, this is a model where accelerators and validated connectors are central to de-risking complex moves off legacy estates and aligning project timelines with business expectations.

Ecosystem partnerships shape ERP roadmaps. The long-standing collaboration between Oracle and Vertex, combined with OCI’s platform capabilities, highlights how ecosystem depth influences ERP buyers’ confidence in long-term tax, compliance, and performance outcomes. This use case signals that validated integrations, shared roadmaps, and cloud-optimized joint solutions are becoming decisive factors in platform and partner selection.