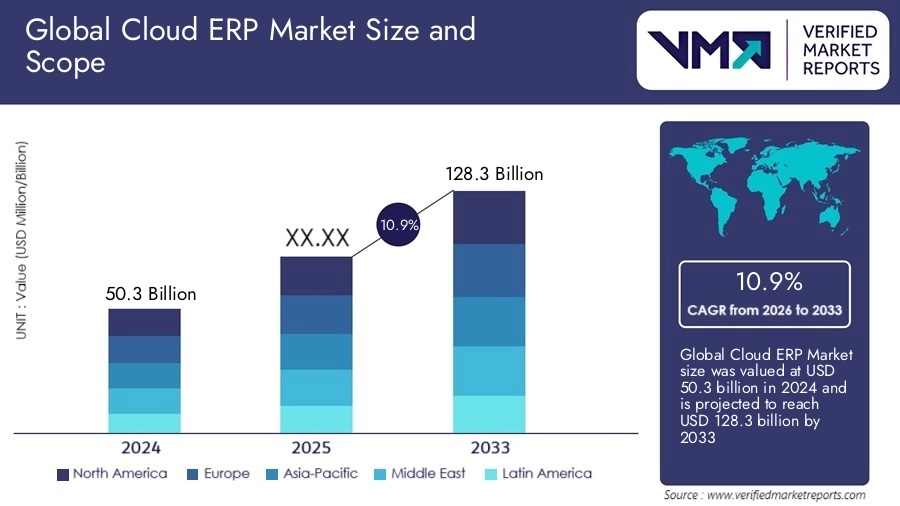

Japan’s cloud ERP market is positioned for substantial expansion, with projections indicating a CAGR of 20.1% through 2032, driven by government-backed digital transformation initiatives and AI-enabled solutions. Leading vendors such as Oracle, SAP and Microsoft are accelerating cloud ERP deployments across manufacturing and retail sectors, which represent the primary adoption drivers in the Japanese market.

How Cloud ERP Transformation Changes Enterprise Operations

For technology executives managing ERP environments in Japan, recent vendor developments signal fundamental shifts in platform strategy and implementation approaches. In October 2025, SEKISUI Chemical, Fujitsu and SAP Japan announced the modernization of SEKISUI’s global management platform via SAP S/4HANA Cloud, unifying accounting, sales, and purchasing operations for group companies worldwide.

In November 2025, Fujitsu launched the Japan Edition of SAP Fioneer Cloud for Insurance, a localized cloud-based ERP platform tailored specifically for Japanese insurance operations with market-specific compliance features. This development highlights the importance of localization for Japanese enterprises, where regulatory requirements and business practices often necessitate customization beyond standard global ERP configurations.

Major vendor investments underscore the market’s strategic importance. For example, Oracle Japan announced plans in August 2025 to invest more than $8 billion over the next decade to enhance cloud computing and AI infrastructure. Mid-2025 partnerships including the SAP and NTT Data alliance, alongside Oracle’s AI-powered supply chain module launch specifically for Japan, accelerated cloud ERP migration, and digital transformation momentum.

Government support provides critical acceleration for adoption. Japan’s “Vision for a Digital Garden City Nation” program allocates approximately $660 million in grants to local governments promoting digitalization, while subsidies for SMEs adopting cloud and IT tools, combined with tax incentives for digital investments, encourage ERP implementation. These initiatives help businesses streamline operations, improve efficiency, and maintain competitiveness amid rapid technological evolution.

What ERP Executives Should Emphasize

When evaluating cloud ERP providers, technology executives should prioritize platforms offering industry-specific functionality tailored to Japanese regulatory and business requirements. Integration of IoT capabilities has emerged as essential: In March 2025, Epicor Software Corporation introduced Epicor Kinetic 2025, featuring advanced IoT integration for real-time monitoring and predictive maintenance in manufacturing environments. Right now, 65% of Japanese enterprises are actively exploring AI integration within their ERP systems, signaling a significant shift toward intelligent automation, particularly in manufacturing, automotive, and electronics sectors.

Best practices for cloud ERP integration emphasize phased migration strategies that minimize disruption to ongoing operations. Organizations should establish clear data governance frameworks before migration, particularly for financial consolidation and master data management. Manufacturing and retail sectors leverage cloud technologies to enhance supply chain management, inventory control, and customer relationship management, with SMEs adopting cloud ERP systems to access enterprise-level functionalities at reduced cost.

However, significant barriers persist. High implementation costs and deployment complexity deter smaller companies from investing in these systems, while a shortage of skilled IT professionals, largely due to Japan’s aging population, limits adoption pace. Resistance to change in traditional industries relying on legacy software slows modernization of business processes, restricting accessibility and integration speed across the market.

What This Means for ERP Insiders

Government-backed digital transformation creates market expansion but increases localization demands. Japan’s $660 million in government grants and SME subsidies alters the competitive landscape by democratizing cloud ERP access beyond large enterprises, expanding the addressable market substantially. However, this expansion demands that ERP vendors invest in Japan-specific localization, as demonstrated by Fujitsu’s SAP Fioneer Cloud for Insurance with market-specific compliance features. Global ERP providers must balance standardized platform development with country-specific customization, which could create tension.

Manufacturing and IoT integration requirements reshape ERP architectural priorities. The emergence of IoT-enabled ERP platforms providing real-time equipment monitoring and predictive maintenance capabilities signals traditional transactional ERP architectures are insufficient for modern manufacturing requirements. As 65% of Japanese enterprises explore AI integration, ERP vendors must embed machine learning for predictive analytics, supply chain optimization, and financial forecasting as core functionality rather than add-on modules.

Workforce shortages and legacy resistance require alternative deployment models. Japan’s aging population and IT skills shortage fundamentally constrains traditional implementation approaches that depend on extensive technical resources and prolonged deployment cycles. The persistent resistance to change in traditional Japanese industries necessitates new change management methodologies that respect organizational culture while demonstrating rapid value realization.