ServiceNow has outperformed its guidance across most Q3 23 profitability metrics, citing GenAI impact as it increased 2023 subscription revenues and operating margin guidance.

NOW saw total revenues of $2,288m in the quarter, representing 25 percent year‑on‑year (YoY) growth and 22.5 percent in constant currency. Subscription revenues reached $2,216m, representing 27 percent YoY growth, 24.5 percent in constant currency – over one point above company guidance.

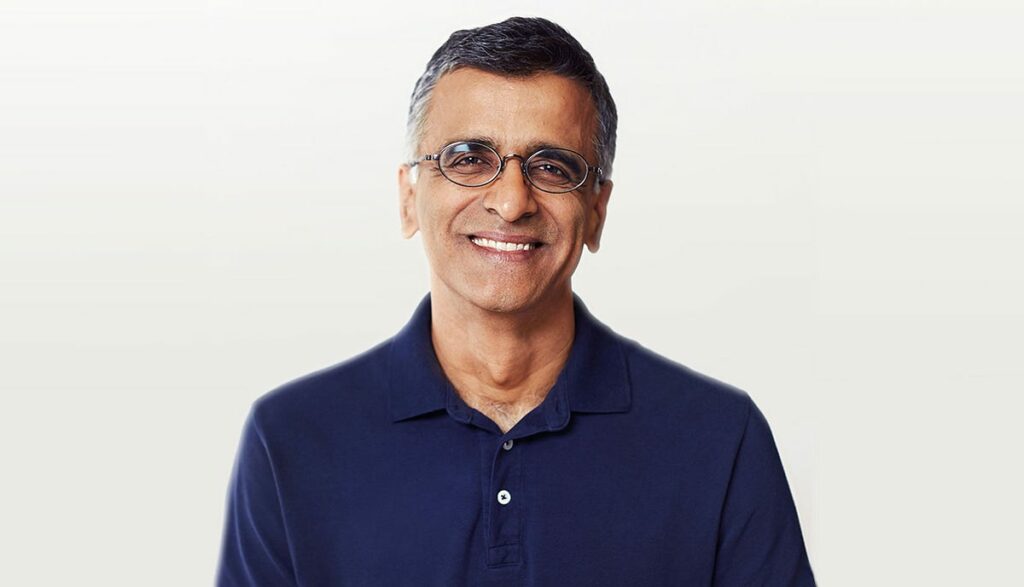

Spurred by GenAI’s “tailwind of growth”, ServiceNow chairman and CEO Bill McDermott said that ServiceNow had “another beyond-expectations quarter”:

“AI has strengthened the market dynamics for enterprise software. ServiceNow is the fastest-growing company in this market at a relative scale. We have the highest rule of 50-plus across our peer set with the highest growth of any other large-cap software company,” McDermott said.

“GenAI represents 36 percent of AI spending overall. We believe every dollar of global GDP will be impacted by AI over the next several years. This isn’t a hype cycle. It is a generational movement. In the last year, ServiceNow has doubled down on our AI investments. Our Vancouver release includes generative AI-powered Now Assist for every workflow.

“Others issued press releases – we released product,” the CEO also teased in a comparison with ERP rivals in the space.

The CEO also explained that ServiceNow boasts over 300 customers in its pipeline from every industry and every stage of testing, with GenAI SKU driving the highest number of customer requests for a pre-release product in the company’s history.

Moving to financial guidance, CFO Gina Mastantuono outlined that the company is raising its full-year outlook to reflect the strength of Q3.

“For 2023, we are raising our subscription revenues outlook by $48m at the midpoint to a range of $8.635bn to $8.640bn, representing 25 percent YoY growth or 25 percent on a constant-currency basis. We’re also raising our full-year operating margin target from 26.5 percent to 27 percent.”

Looking ahead to Q4, the company expects subscription revenues between $2.320bn and $2.325bn, representing 24.5 percent to 25 percent YoY growth or 23 percent to 23.5 percent on a constant currency basis.

New collaborations

Announced alongside its third quarter results, the company shared the news about some key partnerships. Firstly, Deloitte and ServiceNow announced an expansion to their alliance, with Deloitte becoming a pioneering partner and integrating Now’s GenAI capabilities into its operating services globally.

ServiceNow is also scaling its ecosystem globally, with today’s announcement of a co-investment in ANSR, a market leader in enabling companies to scale technology centers.

Another area ServiceNow expects to fuel long-term sustainable growth is industry verticalization with its product development roadmap expanding with use cases and telecommunications, financial services, retail and the public sector.

As the rapid pace of workflow innovation creates an even greater demand for training and skills initiatives, RiseUp with ServiceNow will collaborate with FutureSkills Prime, a digital skilling initiative by the Indian government to train thousands of learners across India in new digital skills to build careers.

Focusing on industry partnerships, McDermott shared that this was the best US federal quarter in ServiceNow’s history as US federal agencies are standardizing on a single platform with a core set of end-to-end solutions. The company cited 19 federal deals over $1m, including three deals over $10m.

The United States Air Force also became the third-largest deal in the company’s history.

Shedding light on some more deals from the quarter, the company said it is collaborating with FedEx to simplify its IT workflows while building a universal employee portal to improve employee experience for 0.5 million global employees.

Other notable collaborations from the period include Philips, Mars, Bank of California, Cleveland Clinic, the US Department of Defense, Fujitsu, Asahi Mutual Insurance and the State of California among others.