It used to be said that no one got fired for buying IBM. But that mantra has sounded increasingly hollow for almost a decade as the once blue-riband brand of enterprise technology has seen its revenues and value consistently slide.

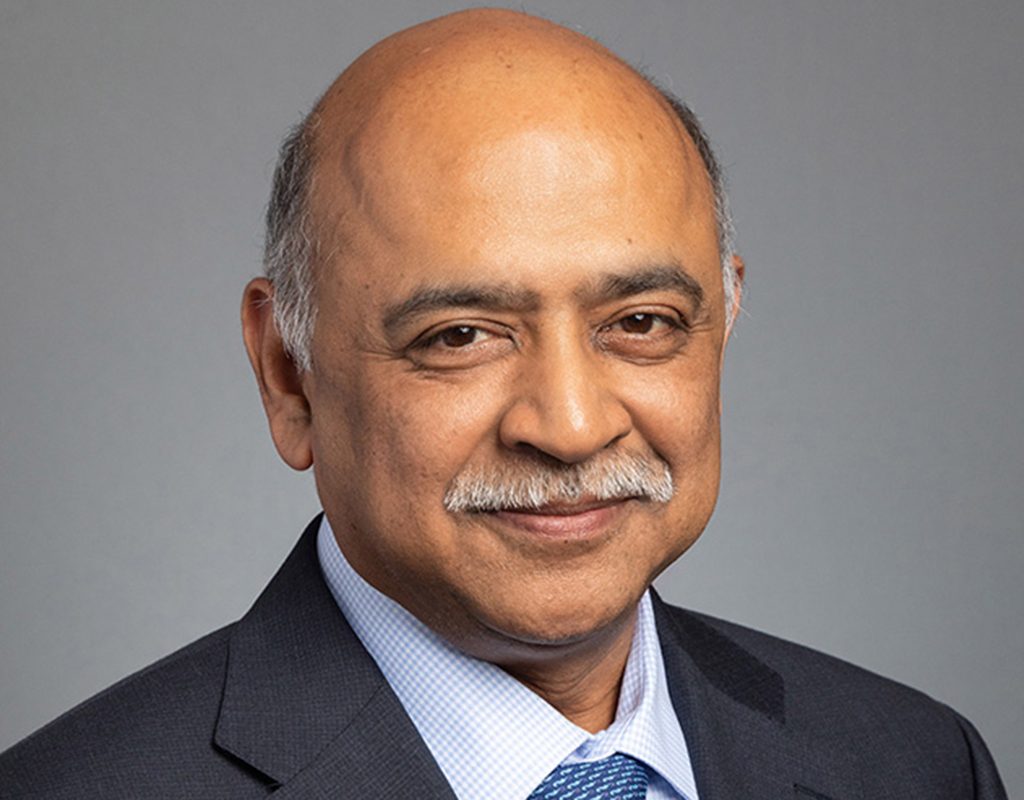

Earlier this year, cloud chief and new CEO, Arvind Krishna, announced a series of goals that were focussed on its hybrid cloud and AI capabilities. To that end, it announced on 12 October that it had spun-off its worst-performing operating unit – its managed infrastructure business – Kyndril, which had reported three consecutive years of declining revenue along with a $2bn net loss last year.

Krishan said: “[The] announcement is a milestone for IBM, its employees and its shareholders as we enter a new era of growth. The separation of Kyndryl is a significant step in the continued evolution of IBM, a company now squarely focussed on delivering powerful hybrid cloud and AI solutions and capabilities to enterprises around the world.”

However, in a recent investor briefing, IBM clarified its forecasts regarding its remaining four key operating units, stating that its business services offering (renamed today as IBM Consulting) would only deliver single-digital revenue growth until 2024 while it estimated its software business growth rate to be in the mid-teens.

Its AI and hybrid cloud business – termed as Cloud and Cogitative Software – is growing and accounts for about 30 percent of total revenue. But they can’t carry the IBM business just yet. Given Krishna’s statement that he wants to “…measure the company on revenue growth”, that appears to put significant pressure on its new Consulting unit, which is predicted to grow by less than 10 percent.

What’s gone wrong for IBM?

IBM’s historical success was rooted in its ability to sell customers a one-stop shop for all its enterprise tech needs: applications to run business processes, the hardware to operate those applications, consulting services to implement those applications and the finance to pay for it all. In 2005 that was a smart play for an enterprise – but not so much these days.

The emergence of more agile offerings has disrupted every aspect of IBM’s ‘stack’ model. The idea that you should buy all your products and services from one provider is over and IBM’s grip on its customer base is vulnerable. The cloud allows enterprise leaders to buy composable elements from multiple suppliers at a lower cost and often with more oomph than the IBM proposition delivers.

To put that into context, IBM’s stock has fallen roughly 20 percent in the last decade while the market has boomed by almost 500 percent. In the same period its revenues have fallen from about $100bn to just $73bn last year. More worryingly, the loss of revenue and value has not been caused by a single event or unique problem. Instead, IBM’s value has been weeping and eroding at a consistent level of decline.

IBM is also an old company. It has structures, processes and legacy which have struggled to keep pace with the market. Transformation in a global manufacturing business with 100 years of history is harder than in a modern financial services business for obvious reasons. The same logic can be applied to IBM’s own transformation which has lagged that of its rivals. Product development, go-to-market strategies and innovation appear stifled in comparison to more nimble competitors – so the question has to be asked, can a spin-off and new name really change its fortunes?

There is also a brand and reputational issue to consider. If you asked a business leader to describe IBM in three words you might get ‘old, expensive and slow’ when the market wants ‘new, value-based and agile’. Can IBM reverse that market perception with a brand refresh which essentially just sticks the word ‘consulting’ in front of its name?

The emergence of the cloud has forced many business leaders to re-evaluate their relationship with technology. Having already been through at least one, and possibly two or three, cycles of new tech – buyers are much savvier today and simply will not tolerate slow and costly innovation.

Ego purchases are rare and the kudos of being a customer of a particular brand fizzled out some time ago. CxOs care little for the brand of their technology – they simply want to invest in whatever products and services deliver the most value in the shortest time, which at present, doesn’t appear to be in IBM’s wheelhouse.

Does all this spell the end for IBM? Well not likely in the short term – IBM’s investment in Red Hat is paying off – although slowly – and the hybrid cloud proposition is a play that will continue to mature. Its venture into becoming a leader in AI could pay long-term dividends but the challenge will be how it integrates its AI innovations in products and services that customers want to buy. The biggest obstacle will be to reform its professional services proposition and, in my opinion, that is a far greater challenge than creating a new logo. Its Consulting unit accounts for almost 20 percent of its revenue and Krishna has clearly stated that IBM is “focussed on delivering hybrid cloud and AI solutions.” I’m not sure where that leaves IBM Consulting, new name or not.