Celonis has secured an additional $1bn in funds to accelerate its position to help customers thrive in challenging economic environments.

This $1bn in liquidity is anchored by a $400m equity raise at a post money valuation of nearly $13bn. In addition, Celonis has expanded its revolving credit facility to obtain access to as much as $600m with a syndicate of leading global banks.

The $400m Series D extension was led by the Qatar Investment Authority (QIA) and includes new blue-chip investors Activant Capital.

Celonis is executing another record year of growth, with more than 2500 enterprise deployments worldwide. The company will use the additional funds to invest in product innovation, drive adoption with Global 2000 customers, expand market potential with acquisition investments, and deepen relationships with ecosystem partners.

The company’s five-year $500m line of credit is expandable to $600m and is the largest syndicated bank recurring revenue revolving credit facility of its kind.

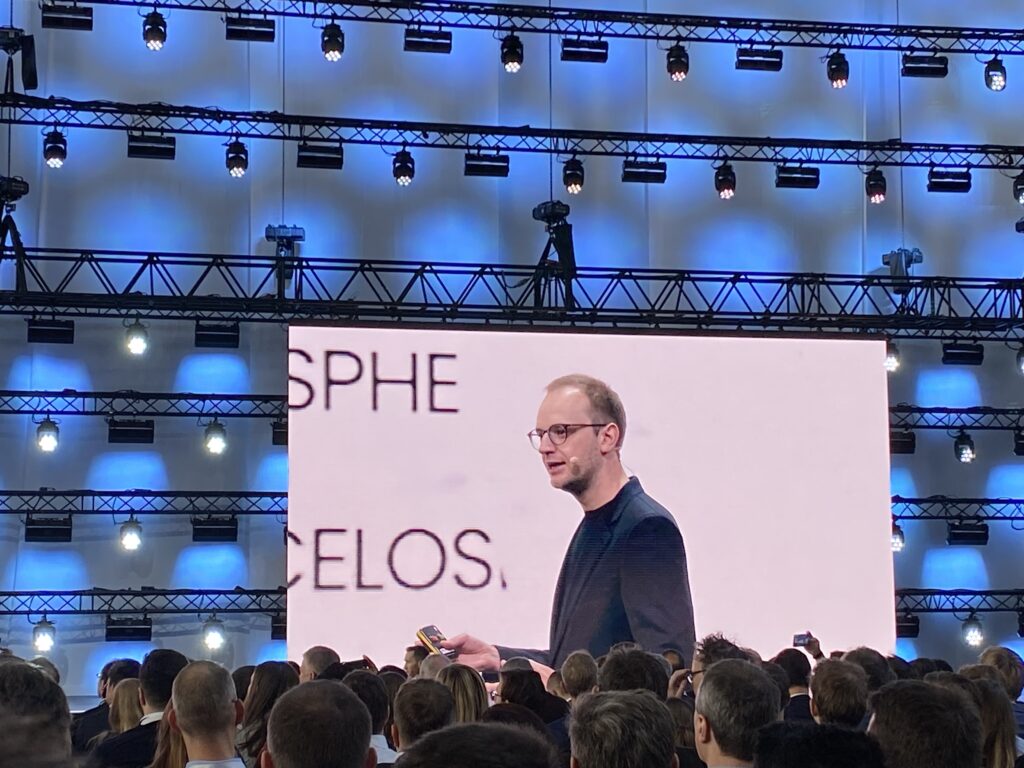

Bastian Nominacher, co-CEO and co-founder of Celonis, said: “Since the first days of Celonis, we have built a company that is operating on sound fundamentals, immutable customer value, and the kind of resiliency that performs at the highest levels in any economic environment. These fundamentals are what puts Celonis in such a unique position to lean into the wind, while others are stepping back. With an additional $1bn in liquidity, Celonis will have maximum flexibility to aggressively innovate, capitalize on new market opportunities, and extend our market leadership.”

Alex Rinke, co-CEO and co-founder of Celonis, added: “There is a ‘behind-the-scenes secret’ that Celonis is equally effective in driving top and bottom line value in both booming and challenging economies. We have never experienced more urgency from customers to use Celonis to hunt down and fix the kind of process problems that can yield tens to hundreds of millions in cash and time savings.”

In June 2021, the company announced its $1bn Series D round at a valuation of $11bn. The Series D followed the Series C financing round of $290m in November 2019, a Series B of $50m in June 2018, and a Series A of $27.5m in June 2016.