IBM has reported better-than-expected Q1 2022 results, with revenue up 8 percent year on year, as the company continues restructuring its business around hybrid cloud platforms, software infrastructure and consulting services.

With analysts predicting the company would report earnings of $1.38 a share on revenue of $13.85bn, IBM beat expectations with adjusted earnings of $1.40 a share on revenue of $14.2bn.

The company’s software revenue was up 12.3 percent in Q1 to $5.8bn, while consulting revenue rose by 13.3 percent to $4.8bn. Hybrid cloud revenue also increased by 14 percent to $5bn.

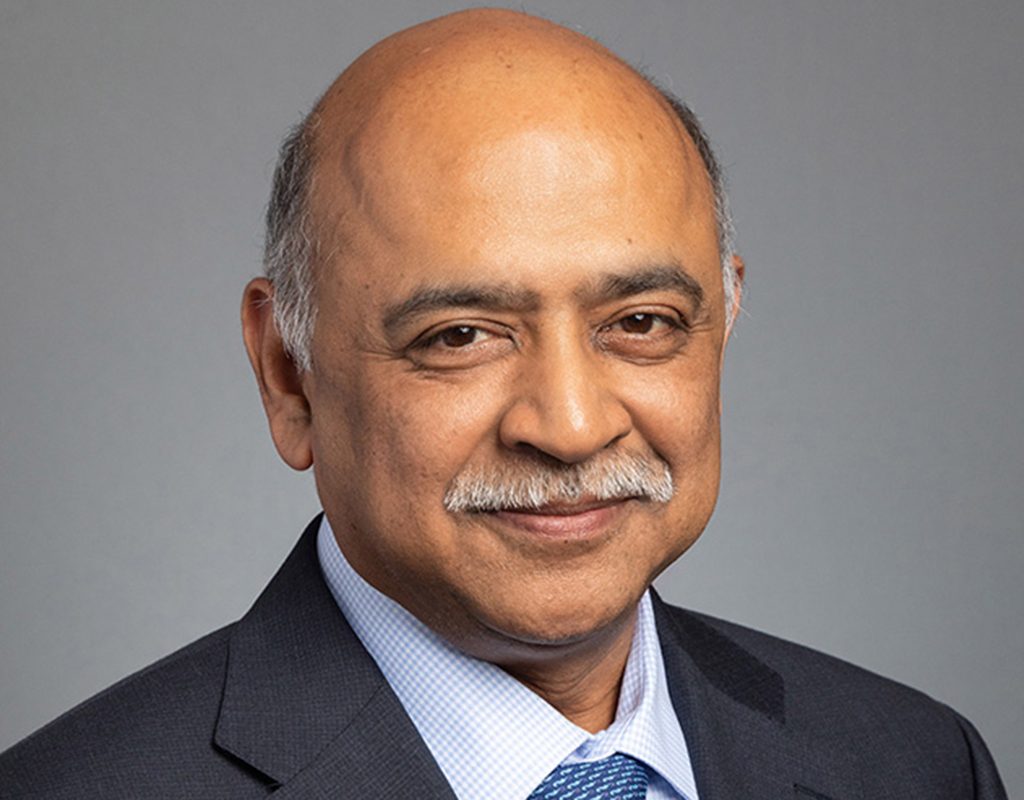

Arvind Krishna, IBM chairman and CEO, said: “Demand for hybrid cloud and AI drove growth in both software and consulting in the first quarter. Today we’re a more focused business and our results reflect the execution of our strategy. We are off to a solid start for the year, and we now see revenue growth for 2022 at the high end of our model.”

James Kavanaugh, IBM senior vice president and chief financial officer, said: “In the first quarter we continued to strengthen the fundamentals of our business, consistent with our medium-term model. We are a faster growing, more profitable company with a higher-value business mix, a significant recurring revenue base and strong cash generation.”

Raising its full-year guidance, the company now expects constant currency revenue growth at the high end of the mid-single digit range for 2022. With sales to Kyndryl adding 5 percentage points to revenue growth this quarter, IBM also expects an additional 3.5 point contribution from incremental sales, though Krishna stated on a call with analysts that Kyndryl won’t be delivering growth after October.