ERP Today has established itself as THE independent voice of the enterprise technology sector through its use of dynamic journalism, creativity and purpose.

SubscribeFinancial Management

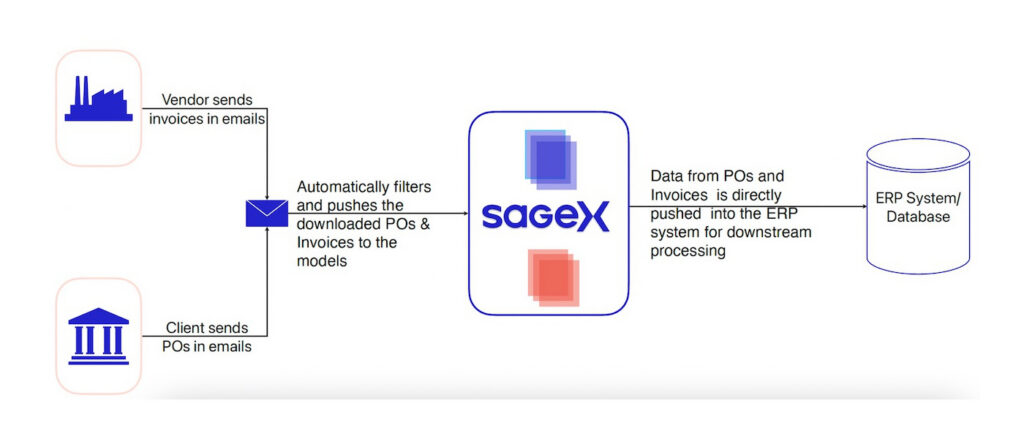

AI Data Transformation Layer Introduced to Eliminate Manual ERP

SageX is leveraging AI-powered purchase order and invoice automation to significantly enhance efficiency, reduce costs, and improve data quality in finance operations, positioning itself as a critical component in the evolving landscape of enterprise AI and ERP systems.

The CFO’s New Mandate for AI Assurance

AI is transforming finance by automating workflows and enhancing decision-making, but CFOs remain accountable for the integrity and explainability of outcomes, necessitating strong governance and reliable data to ensure compliance.

ADP’s Strategic Partnership with Pine Services Group Expands HCM Solutions

ADP and Pine Services Group's strategic partnership aims to enhance AI-enabled human capital management within ERP systems, particularly in project-driven sectors like construction, signaling a shift towards integrated HCM solutions through established ERP channels.

Building a Financial Backbone for Mixed-Application Enterprises with Unit4

Unit4 Financials by Coda is positioned as a financial backbone for mixed-application enterprises. This analysis explores its multidimensional ledger model, cloud deployment options, and low-code integration layer — and what that structure means for finance teams operating across jurisdictions and systems.

KPMG Named SAP Global Strategic Service Partner

KPMG's designation as a SAP Global Strategic Service Partner emphasizes a shift towards modular, cloud-native ERP implementations, prioritizing accelerators and AI-driven solutions over traditional methods.

Compa Raises Series B Funding to Accelerate AI for Enterprise Compensation

Compa's $35 million Series B funding highlights the transition of AI-driven compensation intelligence from experimental to essential infrastructure for large enterprises, enabling real-time pay decision-making.

Liquidity as a Real-Time Operating System: Kyriba on the Future of Treasury

As CFOs face escalating challenges from interest rate fluctuations and FX shocks, they urgently need connected treasury systems that provide real-time liquidity insights by integrating multi-bank and multi-ERP data, enabling strategic decision-making through AI-driven recommendations.

Brex’s ERP Integrations Move Accounting Control Upstream

Brex’s Accounting API connects transaction systems directly to ERP logic, enforcing accounting rules earlier in the process. The shift highlights how accounting control is moving upstream across enterprise finance architectures.

AR Complexity Is Exposing ERP System Limits

A new study examines where ERP systems fall short in accounts receivable, highlighting how automation gaps, system fragmentation, and rising complexity affect cash-flow execution.

Five AI Predictions for Finance From Sage CTO Aaron Harris

Sage Global CTO Aaron Harris outlines five predictions for how artificial intelligence will reshape finance and accounting in 2026. In an interview with ERP Today, he explains why accountability, trust, and system design are becoming central as AI moves into production use.

Acumatica Signals Partner-Led ERP Growth Strategy as Mid-Market AI Adoption Accelerates

At Summit 2026, Acumatica executives highlighted the mid-market ERP shift towards customer-driven AI adoption and partner-led education, advocating for industry-specific AI features while addressing implementation challenges.

Oracle Showcases Sovereign HR Analytics, AI-Driven Finance Automation with e& and Avis Partnerships

Oracle's deployments at e& and Avis Budget Group demonstrate its Fusion AI Data Platform and Fusion Cloud ERP/EPM as key drivers for integrating AI, analytics, and cloud infrastructure in HR analytics and finance automation, respectively, emphasizing the shift from traditional analytics to embedded AI in core workflows.

Pacera Launches to Power Up the Office of the CFO

Pacera, a newly launched software company formed from the integration of Aico, AARO, and Mercur, aims to modernize finance operations by providing a unified platform that enhances automation, insight, and precision for finance teams across Europe.

Financial Close Automation With Full Visibility

Aico helps finance teams automate close activities, strengthen compliance and eliminate manual work.

Japan Cloud ERP Market Growth Expected as Digital Transformation Accelerates

Japan's cloud ERP market is set for substantial growth at a CAGR of 20.1% through 2032, fueled by government digital transformation initiatives and AI solutions, with major vendors driving deployment across manufacturing and retail sectors.

Charted Opens London Office to Take ERP Native AP Automation Deeper into UK, EMEA

Charted is expanding its ERP-native accounts payable automation into London and the EMEA market, focusing on an end-to-end solution fully integrated within ERP systems, while leveraging a partner-led growth model and preparing for region-specific capabilities, including e-invoicing by 2026.

Hg Acquires OneStream to Accelerate Finance AI Platform Development

OneStream has entered a $6.4 billion all-cash acquisition agreement with Hg, enhancing its AI capabilities and signaling intensified competition within the expanding corporate performance management software market.

Healthcare ERP Market Set to Double by 2033 as Hospitals Lean on Finance-Led, On-Premises Platforms

The healthcare ERP market is set to more than double from USD 7.5 billion in 2023 to USD 15.7 billion by 2033, driven by hospitals' need for integrated operations and data centralization amidst rising complexity and regulatory pressures, with finance and billing being the leading segments.

Case Study: Emaar

Emaar decided to replace Spreadsheet Server with Orbit Analytics GLSense to modernise its financial reporting stack without disrupting existing ERP investments. With Orbit GLSense technology, users were able to build consolidated reports and statements that helped in budgeting and forecasting along with closing their period quickly and reliably.

Engineering the Future of Tax with OCI and Vertex

Black & Veatch modernized its tax infrastructure by migrating to Oracle Cloud ERP and Vertex solutions to enhance global compliance, reduce operational risks, and streamline processes, demonstrating the importance of integrated cloud-native tax services for supporting complex multi-jurisdictional operations.

BlackLine Acquires WiseLayer in Bid to Enhance AI Capabilities

BlackLine's acquisition of WiseLayer marks a pivotal moment in finance as AI agents take on complex judgment-heavy tasks, transforming operating models and integration practices while significantly enhancing efficiency and accuracy in financial operations.

Thai ERP Vendor Dynamics Motion Embeds Google Gemini in MotionERP, Cuts System Costs

Dynamics Motion has launched an AI-enhanced MotionERP integrated with Google Gemini, claiming to improve operational efficiencies by over 30% and reduce system costs by more than 3.5 times, positioning itself as a leader in Thailand's ERP market.

BillingPlatform Adds Platform Capabilities for Advanced Revenue Insights

BillingPlatform's upgraded capabilities transform billing into a real-time decision system for revenue leaders, enhancing visibility, reducing manual reporting, leveraging AI for transparency and robust integration.

Rimini Street Pushes Agentic AI into ERP Without Forcing Upgrades

Rimini Street's launch of the Rimini Agentic UX, an AI-driven layer for existing ERP systems, aims to enhance productivity and process automation without the need for costly upgrades as strategic third-party support.

Sage Intacct Launches in Singapore, Bringing Cloud Finance and AI to APAC Growth Plans

Sage has launched Sage Intacct in Singapore to enhance cloud financial management for mid-sized businesses, enabling faster financial closes, compliance with local regulations, and integration across Asia’s complex multi-entity environments.

Oracle NetSuite Recognized as Leader in Gartner Magic Quadrant Reports, as Demand for AI-Driven ERP Accelerates

Oracle NetSuite has been named a Leader in Gartner's 2025 Magic Quadrant for Cloud ERP and Financial Planning Software, highlighting its AI-enhanced capabilities, expanded customer base, and integrated architecture that addresses the evolving demands of service-centric organizations.

Tax Automation Becomes Mission Critical as SAP S/4HANA Transformations Confront Rising Complexity

Tax automation is crucial for successful SAP S/4HANA transformations, as early integration can prevent delays and compliance risks, underscoring the importance of clean data governance and native tax functionality in ERP systems.

Digital Tools Help SMEs Secure Green Financing: New Sage–ICC Report

A new Sage–ICC study reveals that while 70% of SMEs prioritize sustainability, only 3% access green financing, largely due to a lack of quality reporting tools, which impedes their ability to secure funding necessary for sustainable growth.