ERP Today has established itself as THE independent voice of the enterprise technology sector through its use of dynamic journalism, creativity and purpose.

SubscribeFinancial Management

How Tecan Scaled Financial Close Across 40+ Entities with Aico

Tecan, a Swiss leader in laboratory automation, transformed its month-end closing process by implementing Aico's automation solutions, achieving a streamlined, efficient, and finance-managed workflow with minimal IT involvement across its global operations.

Sage 50 Cloud Brings Accounting into the AI Era

Sage has launched Sage 50 Cloud, a fully cloud-deployed accounting solution for SMBs that maintains its familiar interface while enabling AI features like Sage Copilot.

SNP Kyano Foundation – Continuous System Readiness for Real Transformation

In a rapidly evolving business landscape, the Kyano Foundation's Agility Index provides organizations with a data-driven framework to assess and enhance their SAP landscapes, ensuring continuous readiness and successful transformation by replacing assumptions with facts across all phases of migration.

BlackLine Launches Verity™ AI: Trusted AI Purpose-Built for the Office of the CFO

BlackLine's annual conference unveiled Verity AI, a comprehensive suite of AI tools for the Office of the CFO, built on its Studio360 platform, emphasizing data integrity, enhanced visibility, and agentic collaboration, led by an AI team lead named Vera, to provide trusted, auditable financial operations.

Reimagining Finance: Derek Kudsee on Coda’s AI-Powered Future

Derek Kudsee, the new Managing Director of Unit4 Financials by Coda, aims to modernize the finance function through agentic AI and a dynamic system of intelligence while maintaining the platform's core stability that has served enterprise customers for decades.

Driving the Future of Financial Operations: BlackLine

At BlackLine’s annual conference BeyondTheBlack, the 2025 Modern Accounting Awards recognized leaders like American Express Global Business Travel, Cavco Industries, and Wendy's for their exceptional financial transformation journeys using BlackLine's platform.

The Urgency of Modernizing Order-to-Revenue Processes

Businesses must modernize their revenue systems and adopt flexible, data-driven monetization strategies to adapt to rapidly changing buyer expectations and complex pricing models, as legacy systems lead to inefficiencies and customer dissatisfaction.

Enercare Case Study

Zuora not only filled this gap by enabling Enercare to directly bill its large customer base but provided the company with a richer platform to manage customer relationships and support growth beyond billing, improving operations across the entire quote-to-revenue process.

Zuora Order to Cash

Zuora streamlines quoting, billing, usage, and collections with automated revenue recognition, allowing businesses to concentrate on strategy rather than error-prone reconciliation.

How BMC’s ERP Upgrade Transformed Monetization to Power SaaS Growth

When BMC set out to modernize its business systems, the challenge wasn’t just moving from a 20-year-old homegrown ERP billing system; it was enabling a fundamental business model shift from perpetual licenses to SaaS subscriptions, while adding the agility to respond to new go-to-market strategies and complex global billing requirements.

In this fireside chat, ERP Today brings together Ron Clegg, VP, Revenue Office at BMC, Dave Crowell, Partner at PwC, and Rob Newnes-Smith, Zuora Advisor and former CTO for Digital & Employee Tech at Thomson Reuters, to unpack how BMC reimagined its quote-to-revenue process. Together, they explore:

- Sequencing monetization transformation ahead of ERP change to accelerate agility and time-to-market.

- Delivering a “heart-lung transplant” program from CPQ through revenue, consolidating 48+ systems into a unified platform.

- The role of strong process design, change management, and the right partner in ensuring success.

- How these choices reflect a growing market shift toward hybrid revenue models, global billing, and integrated professional services.

Whether you’re a CIO, CFO, or a Transformation Leader, you’ll leave with lessons on deciding core vs. non-core systems, managing large-scale change, and building the agility to support hybrid revenue models, without waiting for a multi-year ERP rollout.

How BMC’s ERP Upgrade Transformed Monetization to Power SaaS Growth

When BMC set out to modernize its business systems, the challenge wasn’t just moving from a 20-year-old homegrown ERP billing system; it was enabling a fundamental business model shift from perpetual licenses to SaaS subscriptions, while adding the agility to respond to new go-to-market strategies and complex global billing requirements.

In this fireside chat, ERP Today brings together Ron Clegg, VP, Revenue Office at BMC, Dave Crowell, Partner at PwC, and Rob Newnes-Smith, Zuora Advisor and former CTO for Digital & Employee Tech at Thomson Reuters, to unpack how BMC reimagined its quote-to-revenue process. Together, they explore:

- Sequencing monetization transformation ahead of ERP change to accelerate agility and time-to-market.

- Delivering a “heart-lung transplant” program from CPQ through revenue, consolidating 48+ systems into a unified platform.

- The role of strong process design, change management, and the right partner in ensuring success.

- How these choices reflect a growing market shift toward hybrid revenue models, global billing, and integrated professional services.

Whether you’re a CIO, CFO, or a Transformation Leader, you’ll leave with lessons on deciding core vs. non-core systems, managing large-scale change, and building the agility to support hybrid revenue models, without waiting for a multi-year ERP rollout.

AARO Joins Forces with Aico & Mercur to Form Unified and Complete Financial Corporate Performance SaaS Platform; Michael Teixeira Named Group CEO

Accel-KKR has successfully merged AARO with Aico and Mercur to create a unified SaaS platform for Corporate Performance Management, led by CEO Michael Teixeira, enhancing financial operations for CFOs across EMEA.

Encore Case Study

Explore how the implementation of GLSense not only fulfilled Encore's specific reporting needs but also strategically positioned the company to achieve sustained expansion and operational superiority within the event technology and production services sector.

Orbit Analytics Launches Blaze Adaptive Memory for GL Sense

Orbit Analytics has launched an intelligent upgrade to its GL Sense reporting solution for Oracle ERP users, featuring the new Blaze Adaptive Memory technology that enhances real-time data accessibility and reporting efficiency by adapting to user behavior.

Why Billing Doesn’t Belong in ERP: Insights from ISG & 24 Hour Fitness on Accelerating Digital Transformation

This webinar explores why modern businesses like 24 Hour Fitness are unbundling billing from ERPs to accelerate transformation, featuring expert insights from ISG and Zuora.

Adapt fast & monetize any business model

Take an interactive tour of Zuora Billing and see how it streamlines quote-to-cash, handles complex pricing models, and empowers teams to quickly adapt to market changes.

How ERP System Integration Can Improve Your Financial Close

ERP system integration streamlines the financial close process by automating data collection, reducing errors, and providing real-time insights, ultimately enhancing efficiency, compliance, and decision-making for enterprises.

SAP Users: Automating SAP Financial Closing with Aico

The article discusses the complexities and manual nature of financial closing in SAP, highlighting the benefits of automation—such as increased efficiency, enhanced accuracy, regulatory compliance, cost savings, and improved visibility—while emphasizing the necessity for organizations, particularly CFOs and finance leaders, to adopt automated solutions like Aico to streamline the closing process and reduce reliance on manual tasks.

How SAP users can simplify non-trade intercompany invoicing with Aico

Aico enhances the efficiency and accuracy of non-trade intercompany invoicing within SAP by automating processes, ensuring compliance, and reducing manual errors, thus addressing the complexities and challenges faced by large enterprises in managing intercompany transactions.

Aico’s guide to non-trade intercompany invoicing

This guide highlights the challenges of non-trade intercompany invoicing, including inefficiencies of traditional ERP systems and common errors, while outlining strategies for implementing streamlined, automated processes to enhance accuracy and mitigate reporting risks.

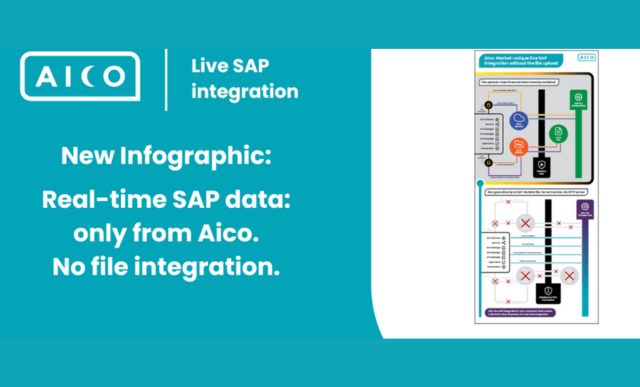

Genuine live SAP integration without the file upload

Aico’s live SAP integration provides real-time access to financial close data, eliminating batch uploads and file transfers to enhance accuracy and streamline decision-making for finance teams.

Intercompany Invoicing

Aico eliminates manual intercompany invoice matching as the reference field in the correct sister company’s ledger is identical.

Closing Task Manager

Access a centralised dashboard that provides real-time updates on every stage of the financial close process. Tasks are seamlessly linked, so one team member can pick up where another left off, ensuring continuity and efficiency.

Accelerating Digital Transformation and Billing Modernization

By focusing fully on all potential sources of value, a truer picture emerges, one that focuses on the impact on the business rather than a narrower cost savings discussion. An independent revenue platform also contains a valuable source of data on customer behavior and product and service performance.

Case Study: 24 Hour Fitness

Learn how 24 Hour Fitness overcame ERP limitations by implementing Zuora to support new pricing strategies, improve billing agility, and better serve over 1 million members.

Modernizing ERPs for Order-to-Cash

Traditional ERPs weren’t built for today’s dynamic revenue models. Zuora helps modernize your order-to-cash journey by decoupling billing, revenue, and subscription management from legacy systems.