APIs continue to be one of the most talked about technologies, as finance leaders look to make their treasury and payments operations more real-time and responsive to market volatility.

APIs continue to be one of the most talked about technologies, as finance leaders look to make their treasury and payments operations more real-time and responsive to market volatility. APIs are critical to the future of bank connectivity, yet they offer significantly more value than connecting treasury systems and ERPs to banks.

In a recent webinar, Celent’s head of banking and payments, Patricia Hines, and Kyriba’s global head of marketing strategy, Bob Stark, explored how APIs are transforming the ways corporate finance teams access and use data. They discussed the many benefits of API adoption, including connectivity, reporting and analysis, accelerated payments and more.

On-demand, real-time connectivity

APIs, or Application Programming Interfaces, are sets of protocols and tools that allow different software applications to communicate with each other. They enable different systems, including banks, ERPs, payment networks, treasury management systems, data lakes, data warehouses and other internal and external systems, to connect and exchange information on demand and in real time. APIs seamlessly embed this data within various workflows across treasury and finance, enabling a complete enterprise picture of cash and liquidity.

Up-to-date reporting and analysis

Real-time data connected and unified from multiple streams means the most up-to-date information is available for reporting and analysis. APIs can feed into reporting that delivers comprehensive, instant visibility into where your cash is and what actions you need to take. By enabling seamless communication beyond ERP-bank-API connectivity, APIs offer many benefits for reporting and analysis, including flexibility to extract precisely the data needed for analysis, reporting consistency across multiple sources, automatic data retrieval at scheduled intervals or in response to specific triggers and authentication protocols and secure connections to protect sensitive information.

AI and Data Science

Because APIs unify and connect data in real time, they provide clean, solid data and also allow organizations to access more detailed data. APIs help create a data platform, or a “single source of truth,” setting the table for the use of AI and empowering organizations to make data-driven, informed decisions. As Bob emphasized, “You don’t have an AI strategy without a data strategy, and you don’t have a data strategy in treasury without APIs.” The uniform, enterprise-wide data delivered by APIs allows organizations to leverage other capabilities for automation, predictability and analytics.

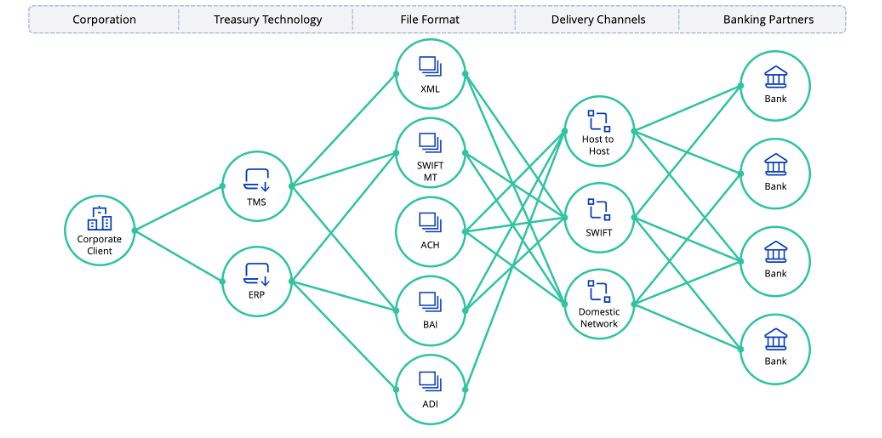

Automatic Translation of File Formats

With many different types of formats for bank reporting and payments, format transformation can be challenging, time-consuming and costly. Many banks also have their own file formats and their own communications protocols, presenting challenges for technical on-boarding. Additionally, banks may limit file format options (e.g., BAI or EDI) and the various channels for interaction (host-to-host, SWIFT, domestic networks) add complexity. Further complicating matters are the SWIFT MT to MX migration and the adoption of ISO 20022.

By automatically converting formats for seamless communication between disparate systems, APIs help solve the challenge of translating the multiple bank reporting and payment formats used to exchange payment instructions and reporting information.

Accelerated, secure payments

API technology is revamping how companies manage their payment journey by enabling machine-speed transactions, efficiently and securely. Beyond delivering automated format transformation and streamlined connectivity, APIs enable automatic checks of payments before they are sent to banks. APIs facilitate standardized payment controls, such as digital signatures, additional levels of approval, single sign-on (SSO) and audit trails.

Additionally, APIs improve payment governance with real-time fraud detection, sanctions list screening, bank account verification and digital policy compliance. Any suspicious activity or detail within a payment instruction means the payment is instantly quarantined, ensuring security and comfort that the right payments are being transmitted to banks.

Streamlined corporate processes

APIs enable improved business outcomes. They can streamline processes, delivery and intelligence for cash and liquidity management, investing, borrowing, foreign exchange, accounting, supply chain finance and payments. APIs provide the opportunity to re-explore existing processes, encouraging corporates to ask: What can we do with richer information? With faster information? How can we better present information for ourselves and our colleagues? What do we want to do differently and better than we are doing today?

Easy to adopt

Instead of creating custom integrations for each bank and payment provider, developers can leverage existing APIs, saving time and resources. API development and implementation is now easier than ever with API marketplaces where the hard work has already been done.

Many banks and technology partners offer API marketplaces with pre-built, pre-developed and pre-tested APIs. Organizations can leverage these pre-built solutions to decrease implementation time from months to days. For example, with Kyriba’s API gateway, clients can seamlessly connect via Kyriba to over 1,000 global banks, supported by an extensive format library of 50,000 pre-developed and pre-tested payment scenarios.

Avoid the rip-and-replace approach

APIs augment, complement and improve–but do not necessarily replace–existing systems. Choosing API solutions doesn’t require a complete overhaul of existing systems. Businesses can integrate API functionalities like real-time reporting and instant payments alongside their current ERP systems without disrupting established workflows. The goal is not a massive rip-and-replace project, but rather the opportunity to enhance existing treasury operations with more on-demand capabilities, facilitating real-time decision-making.

Flexibility to view real-time data whenever, wherever

APIs offer the flexibility to access real-time data from treasury systems and other sources. Combined data from different streams can be fed instantly for viewing in your treasury management system, your ERP, your desktop or your phone. You can consume data where you want and how you want, on-demand and in real-time.

How to get started with APIs

Taking the first step toward adopting APIs involves engaging with your banking partners. While it might seem like a daunting discussion, approaching it as a conversation about connectivity – and exploring the possibilities APIs can deliver beyond ERP-bank-API connectivity – can be insightful. Many forward-thinking banks treat APIs as a product, offering support and sales assistance.

Understanding the potential outcomes and benefits before entering the conversation is crucial. First, you need to clarify your objectives and envision the business outcomes you aim to achieve. Next up, consider the ways APIs can enhance existing processes for cash management, liquidity, investing, borrowing, hedging and payments. Finally, hold banks accountable for meeting your technological needs.

APIs offer the opportunity to accelerate and enhance your business processes. Collaborating with your banking partners, ensuring alignment with your technology stack and envisioning the improvements you seek will help you successfully navigate your API journey.

Watch this webinar replay to learn more about the benefits APIs can unleash for your organization, jointly presented by Celent and Kyriba.